Should you declare your electronics when travelling?

As travellers we're all familiar with the dance of customs declarations. But the rules can be a bit fuzzy when it comes to our beloved gadgets. You may have seen articles about SARS clamping down on bringing electronics back into the country with customs legislation.

What does this mean for you and your personal possessions? Do or don’t require the DA65 form, for example? Let's clear up some confusion around declaring electronics when entering South Africa after a business travel trip abroad.

About Flight Centre Travel Group

The Flight Centre Travel Group is one of the world’s largest travel retailers and corporate travel managers. The company, which is headquartered in Brisbane, Australia, has company-owned leisure and corporate travel business in dozens of countries, spanning Australia, New Zealand, the Americas, Europe, the United Kingdom, South Africa, the United Arab Emirates, and Asia. ASX listed Flight Centre Travel Group (FLT) also operates the global FCM corporate travel management network, which extends to more than 100 countries through company-owned businesses and independent licensees, along with Corporate Traveller, the flagship business specific to the small-to-medium-sized enterprise sector. For more information, visit fctgl.com.

Related stories

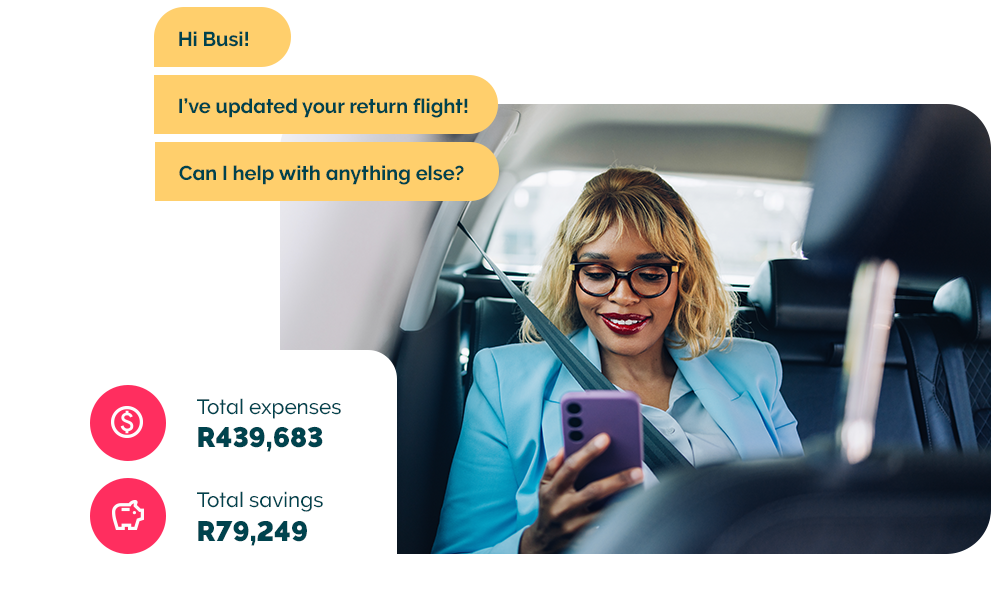

It's time for better business travel management

- Dedicated travel manager

- Intuitive all-in-one travel platform

- Search, book, and report in minutes

- 24/7 emergency support & live-chat

- Exclusive deals, negotiated rates, and more!